Lower your taxes while supporting AJC!

A Win-Win for Students and Supporters

Receive a 65% Virginia state tax credit through our EISTC Program!

Students from low-income families, who would otherwise not have access to private school education, now have this opportunity. Supporters of the Anna Julia Cooper Scholarship Foundation make this possible for children in need AND realize a significant tax savings as a result.

Anna Julia Cooper is an approved organization under the Education Improvement Scholarships Tax Credits Program (EISTC), administered by the Virginia Department of Education (VDOE). Individuals can follow the steps below to make a donation of cash or marketable securities to receive tax credits in Virginia equal to 65% of the donation.

How to make an EISTC donation:

-

Complete Preauthorization Form and return to AJC, who will submit your Preauthorization Form by secure electronic dropbox to the VDOE for approval of your Tax Credits. Do this in one of two ways:

-

- Download and complete the form and return by mail to Anna Julia Cooper School at 2100 N. 29th St. Richmond, VA 23223. Do not include your donation at this time.

CLICK HERE to download the pre-authorization form

OR

- Complete an electronic form available using secure Docusign process.

CLICK HERE for online Docusign form

-

Wait for the Preauthorization Notice, which will arrive by email from AJC.

-

Sign the Preauthorization Notice and return to AJC with your check made payable to Anna Julia Cooper Scholarship Foundation or AJCSF.

Contact Katherine Reid for more information at reidk@ajcschool.org or (804) 822-6610.

For gifts of securities, please email Laura McGowan at McgowanL@ajcschool.org for instructions.

Highlights of the Education Improvement Scholarships Tax Credit program

- Tax credits distributed on a first-come, first-served basis

- Minimum donation is $500 per year

- Maximum donation is $125,000 per year for individuals and married couples

- No dollar limit on donations for businesses

- Donations of cash and marketable securities are allowable

- Tax credits may be carried over for five succeeding years

- Businesses may claim the credit against:

- Corporate Income Taxes;

- Virginia Bank Franchise Tax;

- Virginia Public Service Corporations Tax;

- Individual Income Tax

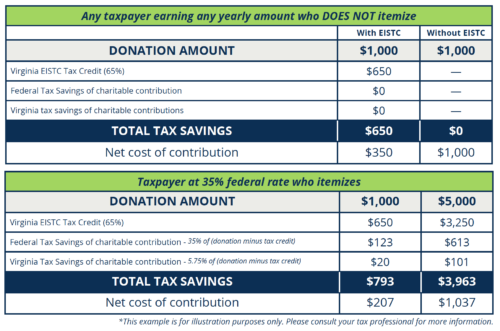

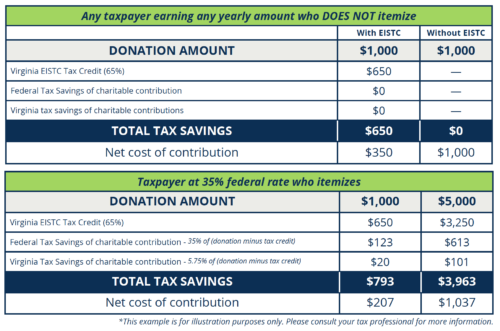

Example Donation and Tax Savings

**Anna Julia Cooper Scholarship Foundation is not qualified to offer personal tax advice. Please consult a tax professional if you have questions regarding tax implications of making a gift such as this.**